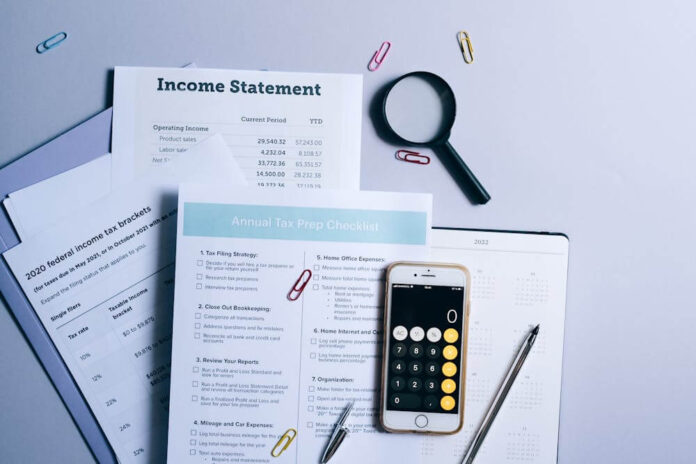

Tax season can be a stressful time for many, especially when financial documents and records are scattered across multiple places. In fact, many taxpayers lose out on potential deductions simply because they aren’t organized ahead of time. Procrastination may lead to rushing through the process, increasing the chances of errors and overlooking tax-saving opportunities. Proper financial organization and using all of the free tax tools available to you before tax season not only helps you file more efficiently but it can also save you money.

This article will guide you through some essential steps to help you get organized and avoid the chaos that often comes with last-minute tax preparation.

How Categorizing Your Expenses Can Help You Save

Properly categorizing your expenses throughout the year is a key element of organizing your finances for tax season. Different expenses can qualify for various deductions, and separating personal, business, and medical expenses can make a big difference in your final tax bill.

For example, if you run a small business or do freelance work, many of your business-related expenses, such as office supplies, utilities, and travel, can be deducted. However, if you don’t keep a clear record of these expenses, you might miss out on those tax-saving opportunities. Keeping your receipts and tracking expenses in a simple spreadsheet or financial app throughout the year will pay off when it’s time to file.

Managing Tax Preparation Costs Efficiently

Tax preparation, whether done on your own or through a professional, can come with costs that vary depending on the complexity of your financial situation. Organizing your documents ahead of time can significantly reduce tax preparation costs. Many tax preparers charge by the hour, so having everything ready, from income reports to expense records, means they can do their job more quickly and efficiently.

Even if you’re using tax software, being organized can reduce the time you spend inputting data and tracking down documents. For those with more complicated tax situations, hiring a professional may seem like an added expense, but it can often lead to bigger savings in the form of missed deductions or avoiding errors. By being prepared, you can manage your tax preparation costs and reduce the overall stress of tax season.

Keeping Track of Charitable Donations for Deductions

Donating to charitable causes not only helps those in need but can also provide valuable tax deductions. However, to qualify for a deduction, the IRS requires proper documentation of your contributions. Whether you donate cash, clothing, or other goods, having detailed records can reduce your tax liability.

Many people forget to track small donations throughout the year or lose receipts, which can mean missed deductions. If you regularly donate to charity, make it a habit to save receipts and keep records of all contributions. Larger donations may require additional documentation, such as a written acknowledgment from the charity, so it’s important to stay organized well before tax season begins.

Reviewing Investment Records to Ensure Accuracy

Investments can be a great way to build wealth, but they also add complexity to tax filing. If you have investments, such as stocks, bonds, or mutual funds, it’s important to gather all relevant documents, including 1099-B forms that report capital gains and losses. Failing to report these gains or losses can trigger IRS scrutiny.

In addition to gathering your investment records, reviewing them for accuracy is crucial. Investment income can sometimes be misreported, leading to discrepancies in your tax return. Organizing and reviewing your investment records ahead of time will help ensure that your tax filing is smooth and that you won’t face any surprises later.

Maximizing Tax Deductions by Organizing Receipts and Documentation

One of the most effective ways to lower your tax bill is by claiming deductions. However, you can only claim what you have proper records for. If your receipts and documentation are scattered or lost, you could miss out on significant tax savings. Deductions can include anything from medical expenses and mortgage interest to education costs and business expenses. The key is to be organized throughout the year. Create a designated folder for receipts, and consider going digital by scanning and storing them in an organized system. This ensures that, when tax season rolls around, you have all the paperwork you need to claim every eligible deduction.

It’s easy to forget small expenses, but these can add up. Regularly review your records to ensure you haven’t missed any qualifying deductions. An organized approach not only saves you time but can also save you money when you’re filing your return.

Understanding Tax Credits and How to Claim Them

Tax credits are beneficial as they reduce the amount of tax you owe directly. Unlike deductions, which lower your taxable income, credits reduce your tax bill. However, many people either don’t know they qualify for these credits or fail to claim them due to poor organization.

To make sure you’re taking full advantage of all available tax credits, start organizing any supporting documents well before the filing deadline. Keep records related to child care, education expenses, and other tax credit qualifications in one place. This will not only make it easier to claim credits but also ensure you don’t overlook any opportunities to reduce your tax liability.

Keeping Your Retirement Contributions in Check Before Filing

Contributions to retirement accounts can often be tax-deductible, reducing your taxable income and potentially lowering your tax bill. However, in order to claim these deductions, you need to have organized records of your contributions.

It’s also important to ensure that your contributions are within the allowable limits for the year. Over-contributing can lead to penalties. Keep your retirement account statements handy, and if you haven’t maxed out your contributions by the end of the year, consider making a last-minute contribution before the tax filing deadline. This simple step can help you save more on your taxes while also securing your financial future.

In summary, organizing your finances before tax season is crucial to making the process smoother, reducing stress, and potentially saving money. From gathering income statements and tracking expenses to maximizing deductions and credits, every step of organization plays a role in ensuring you don’t miss out on opportunities to lower your tax bill. By staying on top of retirement contributions, keeping records of charitable donations, and knowing when to seek professional help, you’ll be in a better position to file your taxes accurately and on time.