When D’ontra Hughes stepped into the Shark Tank, he was armed with a revolutionary idea that promised to change the way we access cash. His company, Spare, aimed to deliver cheaper cash access by partnering with merchants, offering a better rate than third-party ATMs. Hughes’s pitch was compelling, but would it be enough to secure a deal with the sharks?

The Spare Pitch and Deal at Shark Tank

Hughes entered the tank seeking a $500,000 investment for a 3.5% equity stake in Spare. The valuation, however, could have sat better with the sharks. After some intense negotiations, Mark Cuban agreed to invest $500,000 for a 12% equity stake and 2% advisory shares. It seemed like a done deal, but as viewers would later learn, the agreement was not finalized post-show, and Spare did not end up in Cuban’s portfolio.

Spare Is Gone Out of Business

Despite the setback, Spare continued to grow and thrive. The company’s financial revenue nearly tripled in 2021, reaching an impressive $4.1 million. Spare managed to partner with more than 2,500 merchants who dispense cash at better rates than ATMs.

While some critics argue that the savings are negligible for many people, Spare’s unique proposition offers benefits to both users and businesses.

What Was Spare Net Worth?

Spare’s exact net worth is private. However, based on the company’s impressive revenue growth and expanding partnerships, it’s clear that Spare has been on an upward trajectory.

Regardless of the deal’s outcome, the exposure from Shark Tank undoubtedly played a role in driving the company’s success.

How Does Spare Revolutionize ATM Services?

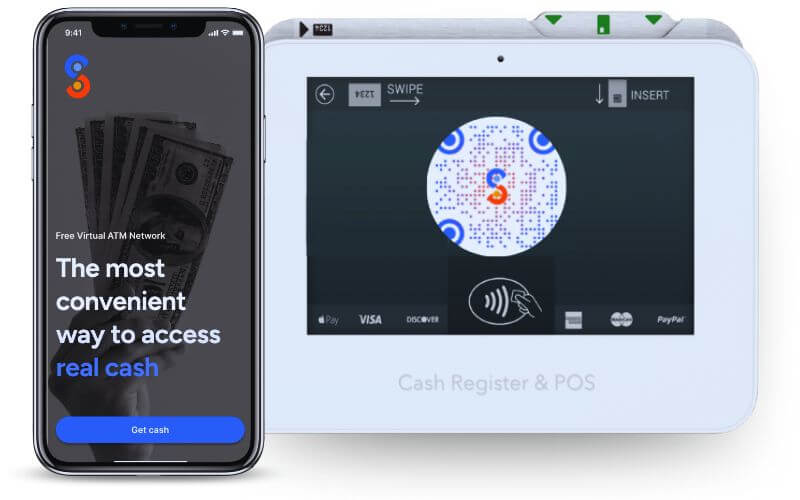

Spare’s platform, initially only available on Apple’s App Store, is now accessible to Android users as well. The service presents an effective way for users to withdraw cash while reducing the amount of cash on hand for local merchants, which can otherwise pose security risks.

Spare also incentivizes businesses to dispense cash to users, potentially improving their organic foot traffic and revenue.

Business Overview

Spare’s business model is built on partnerships with merchants who are willing to dispense cash to users at a better rate than traditional ATMs. By downloading the Spare app, users can locate participating merchants and withdraw cash at a lower fee.

This innovative approach not only benefits the user but also the merchant. By keeping less cash on hand, businesses reduce their security risks. Moreover, by offering this service, merchants can attract more foot traffic and potentially boost their revenue.

Conclusion

Spare’s journey is a testament to the power of perseverance and innovation. Despite not securing a deal on Shark Tank, the company has continued to grow and make an impact. Spare’s unique approach to cash access not only benefits users but also offers a new revenue stream for businesses.

As the company continues to expand its partnerships and user base, it’s clear that Spare is poised to revolutionize the way we think about cash transactions. The future looks bright for this innovative startup, and we can’t wait to see what they do next.

Also Read: