The economy fluctuating like ocean tides is a certainty in finance. Recessions are a natural component of the economic cycle, but the positive aspect is that financial ruin is not a certainty. Although downturns can seem daunting, history consistently demonstrates that careful planning can transform these difficult periods into chances for advancement.

Let’s be honest: No one wants a recession. Even the sharpest entrepreneurs and investors have navigated these challenging times and emerged more resilient. They achieve this by concentrating on investments that endure a recession and flourish.

Understanding Resilient Investments in a Downturn

Not all investments are at risk during a recession. Some assets withstand storms better than others and yield stability and even growth when others crumble.

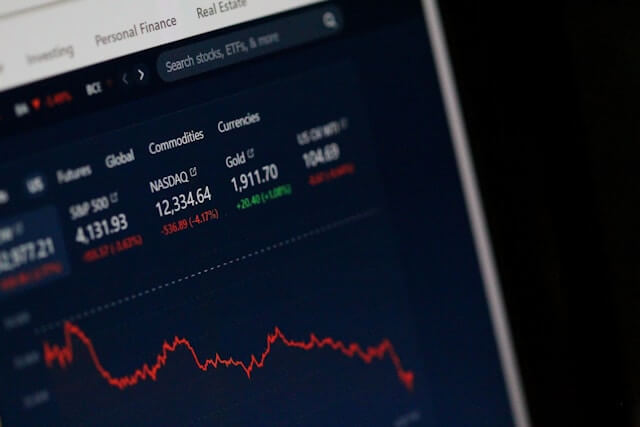

Historically, the best investments during a recession include dividend-paying stocks, defensive industries, and gold. They are popular investment instruments to provide basic needs, retain intrinsic value, or maintain safety and security. Regardless, these items continue to invest their value in an economy that needs more common sense.

Defensive Stocks And Why They Shine Through Recessions

When customers stop spending, investors favor businesses that provide essential services such as healthcare, utilities, and food. These stocks are known as defensive stocks and serve as a protective measure during economic difficulty.

Reflect on the most recent economic decline: supermarkets were consistently crowded, utility expenses continued to be paid, and healthcare remained crucial. Consider companies such as Johnson & Johnson or Procter & Gamble. These organizations typically succeed during recessions since their offerings are essential. While high-growth stocks might struggle, defensive stocks offer reliable returns and reassurance.

Their secret? Consistency. In tough times, consistency wins.

Real Estate: The Evergreen Investment with a Twist

Real estate investment seems more secure, even when other investments falter in economic depression. Nevertheless, it’s essential to understand that properties aren’t created equal, especially when facing a recession. This highlights the distinction between well-informed strategic property decisions that generally remain within financial limits even during an economic downturn. Investors carefully analyze market trends, location, and property types to identify opportunities that retain value and may even thrive in uncertain economic climates.

Rental properties in high-demand areas are a good example. As the affordability of buying houses dips, the latter gain preference and ensure a steady inflow for property owners. Another reliable method of making real estate investments without worrying about property management is through REITs or Real Estate Investment Trusts. In some areas, when commercial space is scarce during the lull, residential and multi-family spaces perform much better. The stability in their demand ensures that money stays there, even on bad market days.

Gold and Precious Metals: The Classic Hedge

Gold is the ultimate safety net investment, and there are valid reasons for this. Gold tends to remain resilient when markets decline, and currencies fluctuate. In the past, investors have traditionally run to precious metals as a haven against the storm.

There’s no need to hide gold bars in your yard. Investing in precious metals is easy nowadays with modern options, such as gold ETFs (Exchange-Traded Funds) and mining stocks. Silver, platinum, and other metals present stability in shaky markets. They don’t make much for themselves, but a safety net holds value.

Bonds and Fixed-Income Investments for Smooth Growth

If you prioritize security for your money, bonds make sense. They are considered a recession-proof investment. Unlike equities, bonds have low risk and provide steady payouts. Even people wary of investment risks choose this option.

Government bonds like U.S. Treasury bonds are among the safest options. The government backs them and provides consistent interest payments. Corporate and municipal bonds are other options, offering slightly higher returns but manageable risk.

Fixed-income investments safeguard capital and ensure steady cash flow even when other markets are volatile. Having a constant source of income can be helpful during an economic downturn.

Diversification: Avoid Putting All Eggs in One Basket

Recessions remind us why diversification is essential. It entails investing across asset classes to prevent a portfolio from being destroyed by a single market slump.

For example, defensive equities, real estate investments, and precious metals like gold can be combined to create a safety net against downturns in other parts of your financial landscape. Think of your investing portfolio as a carefully planned, nutritious dinner, with each ingredient essential to your well-being. Like a well-balanced diet, which needs a variety of proteins, carbohydrates, and vibrant veggies to support health, a diversified portfolio is your tactical guide to obtaining resilience and financial stability in a constantly shifting market.

Avoiding Pitfalls: What Not to Do During a Recession

During a recession, even the most experienced investors can make blunders. One of the most frequent errors is panic selling. The instinct to stem potential losses can cause hasty decisions that lead to market falls. Selling assets at a low point only cements those losses rather than providing relief.

Another significant pitfall is overleveraging. Some investors frequently take on excessive debt to increase returns without thoroughly weighing the consequences. This tactic can quickly backfire in market turbulence and cause significant financial hardship. Exercising discipline and staying focused on long-term financial goals is critical rather than chasing after quick profits.

It’s critical to remember that recessions are brief stages of the economic cycle. The wisest investors remain composed during these tumultuous times, concentrating on the bigger picture rather than getting entangled in the current chaos. By standing back and keeping a level head, they put themselves in a position to withstand the storm and become more potent when things get better.

The Road Ahead: Building Financial Resilience

Undoubtedly, recessions can cause anxiety and uncertainty, but they can also present a unique chance to examine and arrange your financial situation. During challenging economic times, consider the potential benefits of investing cautiously, strategically diversifying your portfolio, and steering clear of common financial pitfalls many encounter.

You may put yourself up for significant growth when the economy inevitably recovers by protecting your assets and taking preventive measures now. Remember that being truly resilient means surviving adversity and figuring out how to thrive in its wake and come out stronger and more capable than before.